Examining the Effectiveness of Income Inequality Policies in the US

Examining the effectiveness of current US policies aimed at reducing income inequality involves a data-driven analysis of various measures, assessing their impact on wealth distribution and overall economic fairness.

The persistent issue of income inequality in the United States has spurred numerous policy interventions. This article delves into examining the effectiveness of current US policies aimed at reducing income inequality: a data-driven analysis, offering insights into their successes, limitations, and potential areas for improvement.

Understanding the Landscape of Income Inequality in the US

Income inequality in the United States has been a growing concern for decades. Understanding the extent of this disparity is crucial before examining the effectiveness of current US policies aimed at reducing income inequality: a data-driven analysis.

Several factors contribute to this complex issue.

Historical Trends in Income Distribution

Over the past half-century, the distribution of wealth has shifted dramatically.

- The share of income held by the top 1% has increased significantly.

- Wage stagnation among middle and lower-income earners is a contributing factor.

- Changes in tax policies have also influenced income disparities.

Socioeconomic Factors

Beyond historical trends, socioeconomic factors play a crucial role.

- Educational attainment and access to quality education.

- Racial and gender disparities in employment and wages persist.

- Technological advancements and automation impact job opportunities and wages.

In conclusion, understanding the scope and underlying causes of income inequality is an essential first step in examining the effectiveness of current US policies aimed at reducing income inequality: a data-driven analysis. This understanding provides context for assessing policy interventions.

The Role of Taxation in Addressing Income Inequality

Taxation is a primary tool governments use to address income inequality. Through progressive tax systems, higher earners contribute a larger percentage of their income, which can fund social programs and redistribute wealth.

However, the effectiveness of taxation in reducing income inequality is a subject of ongoing debate.

Current US Tax Structure

The US employs a progressive tax system, but its impact is often debated.

- Marginal tax rates and their effects on high-income earners.

- The role of deductions and loopholes that benefit specific groups.

- Comparison of the US tax system with those of other developed nations.

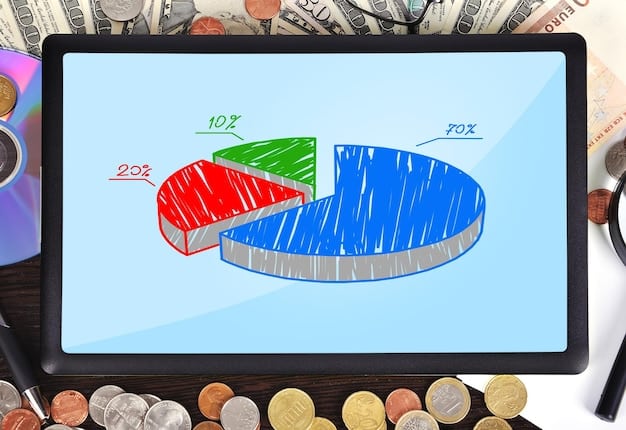

Impact of Tax Policies on Income Distribution

Tax policies can have a direct impact on income distribution.

- Analysis of how different tax brackets affect various income levels.

- Assessment of the effectiveness of tax credits and deductions for low-income individuals.

- Evaluation of estate taxes and their role in wealth redistribution.

In conclusion, taxation is a vital instrument in the fight against income inequality, although its effectiveness relies on the specific tax policies implemented and how they affect different income groups.

Evaluating the Impact of Social Welfare Programs

Social welfare programs serve as a safety net for vulnerable populations, providing essential resources and opportunities. These programs aim to reduce poverty and income inequality by supporting low-income individuals and families.

However, the effectiveness of these programs is often questioned.

Overview of Key Social Welfare Programs

Several programs in the US are designed to support low-income individuals and families.

- Supplemental Nutrition Assistance Program (SNAP) and its effect on food security.

- Temporary Assistance for Needy Families (TANF) and its role in supporting families in need.

- Earned Income Tax Credit (EITC) and its impact on low-wage workers.

Data-Driven Analysis of Program Outcomes

Analyzing the data helps understand the true impact of these programs.

- Poverty reduction rates among program participants.

- Impact on employment and earnings for individuals who receive benefits.

- Long-term effects on families and communities.

In conclusion, while social welfare programs provide crucial support, their effectiveness in significantly reducing income inequality is a point of ongoing study and debate.

The Influence of Education Policies on Income Disparities

Education plays a vital role in determining an individual’s potential earnings and upward mobility. Access to quality education can reduce income disparities by equipping people with the skills and knowledge needed to succeed in the workforce.

However, disparities in educational opportunities continue to contribute to income inequality.

Access to Quality Education

Ensuring equitable access to quality education is a critical challenge.

- The impact of school funding disparities on educational outcomes.

- The role of early childhood education in shaping long-term success.

- The significance of access to higher education and vocational training.

Educational Attainment and Income

Educational attainment is strongly correlated with income levels.

- The wage premium associated with a college degree.

- The impact of vocational training on earning potential.

- The challenges faced by individuals without a high school diploma.

In conclusion, education policies that promote equitable access to quality education are crucial for reducing income disparities and fostering economic opportunity for all.

The Role of Labor Market Policies

Labor market policies significantly influence income distribution and worker well-being. Policies such as minimum wage laws, collective bargaining rights, and worker protection regulations can impact wages, benefits, and job security.

However, the effectiveness of these policies in reducing income inequality is debated.

Minimum Wage Laws

Minimum wage laws aim to provide a minimum standard of living for workers.

- The impact of minimum wage increases on low-wage workers.

- Potential trade-offs between higher wages and employment levels.

- Comparison of minimum wage policies across different states and countries.

Collective Bargaining and Worker Rights

Collective bargaining can empower workers to negotiate for better wages and benefits.

- The role of unions in advocating for worker rights.

- The impact of declining union membership on wage inequality.

- The importance of worker protection regulations in ensuring fair labor standards.

In conclusion, labor market policies can influence income distribution and worker well-being, but their effectiveness in reducing income inequality depends on their design and implementation.

Analyzing the Impact of Housing Policies

Housing policies play a crucial role in shaping economic opportunity and reducing income inequality. Access to affordable housing can free up income for other essential needs, while discriminatory housing practices can perpetuate economic disparities.

The effectiveness of housing policies in addressing income inequality is vital.

Affordable Housing Initiatives

Affordable housing initiatives aim to increase access to safe and affordable housing.

- The role of government subsidies and tax credits in promoting affordable housing development.

- The impact of rent control policies on housing affordability.

- The importance of addressing housing discrimination in ensuring equitable access to housing opportunities.

Housing and Economic Opportunity

Housing can influence economic opportunity and social mobility.

- The impact of residential segregation on access to jobs, schools, and other resources.

- The role of homeownership in building wealth and economic stability.

- The challenges faced by low-income individuals and families in accessing affordable housing in high-opportunity areas.

In conclusion, housing policies have a significant impact on economic opportunity and income inequality. Effective policies can promote access to affordable housing and foster economic mobility for all individuals and families.

| Key Point | Brief Description |

|---|---|

| 📊 Income Inequality Trends | Highlights the growing gap between high and low-income earners in the US. |

| 💰 Taxation | Discusses the role of progressive taxation in income redistribution. |

| 🧩 Social Welfare | Examines the impacts of SNAP, TANF, and EITC on poverty reduction. |

| 🎓 Education | Highlights the need for equitable access to quality education. |

FAQ

Several factors contribute to income inequality, including technological advancements, globalization, and changes in tax policies. Socioeconomic factors like education and racial disparities also play a significant role.

Tax policies can either reduce or exacerbate income inequality. Progressive tax systems, where higher earners pay a larger percentage of their income, can help redistribute wealth and fund social programs.

Social welfare programs like SNAP (food stamps) and TANF (cash assistance) provide a safety net for low-income individuals and families. These programs can reduce poverty and improve living standards.

Education is a critical determinant of an individual’s earning potential. Disparities in educational opportunities can perpetuate income inequality, as those with better education are more likely to secure high-paying jobs.

Labor market policies include minimum wage laws and regulations that protect workers’ rights. These measures can boost wages for low-income workers and promote fair labor standards, thereby reducing income inequality.

Conclusion

In conclusion, examining the effectiveness of current US policies aimed at reducing income inequality: a data-driven analysis reveals a multifaceted landscape. While various policies attempt to address the issue, ongoing evaluation and adaptation are essential to achieving meaningful progress towards a more equitable society.