Gen Z’s Response to Economic Inequality: Can New Policies Reduce Income Gap?

The prospect of new policies aiming for wealth redistribution to reduce the income gap by 10% in the next five years, especially concerning Gen Z, remains a complex challenge, requiring robust economic reforms and sustained societal commitment.

The economic landscape inherited by Generation Z is marked by stark inequalities, driving a unique and vocal response from this demographic group. Understanding Gen Z’s Response to Economic Inequality: Can New Policies Aimed at Wealth Redistribution Reduce the Income Gap by 10% in the Next 5 Years? is crucial for policymakers and economists alike as we look towards a more equitable future. This article delves into the potential of new policies to significantly impact income disparities.

Understanding Gen Z’s Economic Predicament

Generation Z, broadly defined as those born between the mid-1990s and early 2010s, faces an economic reality substantially different from previous generations. They entered adulthood amidst rising student debt, escalating housing costs, stagnant wage growth relative to inflation, and the lingering economic scars of the 2008 financial crisis and the more recent COVID-19 pandemic. These factors collectively contribute to a pervasive sense of economic insecurity and a heightened awareness of wealth disparity.

This generation is also the first to grow up entirely in the digital age, with constant exposure to global economic trends and social injustices through social media. This exposure amplifies their understanding and frustration with systemic inequalities, fostering a collective desire for change. Their economic precariousness is not just anecdotal; data consistently shows that younger generations accumulate wealth at a slower rate than their predecessors at similar life stages.

The Burden of Student Debt

One of the most defining economic challenges for Gen Z is student loan debt. The cost of higher education has soared dramatically over the past few decades, often far outpacing inflation and wage growth. This means many graduates start their careers with significant financial burdens, delaying major life milestones such as homeownership, marriage, and starting families. The debt acts as a drag on their economic mobility and overall financial well-being.

- Average student loan debt per borrower continues to rise, impacting Gen Z disproportionately.

- High interest rates exacerbate the long-term financial strain.

- The link between educational attainment and economic opportunity is increasingly tenuous for those saddled with debt.

This debt also exacerbates the wealth gap, as those from less affluent backgrounds are often more reliant on loans to finance their education, creating a cycle of disadvantage. Addressing student debt relief is often cited as a critical first step in alleviating economic pressure on this generation and fostering broader economic equity.

Housing Affordability Crisis

Another significant hurdle for Gen Z is the astronomical cost of housing. Both rental prices and home values have surged in many urban and suburban areas, making it increasingly difficult for young people to afford independent living or to enter the housing market. This forces many to live with parents longer, or to spend a disproportionate amount of their income on rent, leaving little room for savings or investment.

The dream of homeownership, once a cornerstone of the American middle class, seems increasingly out of reach for many Gen Z individuals. This crisis is not merely a matter of lifestyle; it directly impacts wealth accumulation, as real estate has historically been a primary vehicle for building intergenerational wealth. Policies aimed at increasing affordable housing options and regulating rental markets are thus central to Gen Z’s economic concerns.

In summary, Gen Z’s economic struggle is multifaceted, rooted in a combination of macro-economic trends and specific policy failures. Their lived experiences have made them particularly attuned to issues of inequality and receptive to radical policy solutions. Their response to these challenges is not just passive acceptance, but an active pursuit of systemic change.

Gen Z’s Advocacy for Economic Justice

Gen Z’s Response to Economic Inequality is characterized by a strong advocacy for economic justice, often manifested through social activism, political engagement, and a visible shift in consumer and labor habits. Unlike previous generations that might have adopted more incremental approaches, Gen Z frequently demands fundamental changes to economic systems, viewing existing structures as inherently flawed and biased against them.

Their activism is highly visible on social media platforms, where they organize, share information, and amplify their calls for change. This digital native approach allows for rapid mobilization and the dissemination of ideas, including complex economic theories and policy proposals, to a wide audience. They are less bound by traditional political ideologies, often prioritizing practical outcomes and genuine equity over party lines.

Engaging in Political Activism

Gen Z exhibits a growing propensity for political engagement, frequently participating in protests, advocating for policy reforms, and mobilizing voters. Their political involvement often transcends traditional party affiliations, focusing instead on specific issues like climate change, racial justice, and, notably, economic inequality. They pressure elected officials to enact policies that address wealth disparities, such as higher taxes on the wealthy, universal basic income (UBI), and robust social safety nets.

This generation’s political action is particularly impactful due to its sheer size and increasing electoral power. As more Gen Z individuals reach voting age, their collective voice in elections will become undeniable. Candidates who align with their calls for economic justice are likely to gain significant support, potentially reshaping political discourse and policy priorities.

- Increased voter turnout among younger demographics.

- Active participation in grassroots movements and online advocacy.

- Focus on systemic issues rather than individual responsibility.

Shifting Consumer and Labor Practices

Beyond traditional political avenues, Gen Z’s response to inequality is also evident in their consumer choices and labor practices. They are more likely to support businesses that demonstrate ethical practices, fair wages, and social responsibility. This conscious consumerism puts pressure on corporations to align with values of equity and sustainability, as Gen Z’s purchasing power grows.

In the workplace, Gen Z often prioritizes work-life balance, fair compensation, and purpose-driven employment over traditional career paths solely focused on maximizing income. They are more willing to advocate for their rights as workers, join unions, and challenge exploitative labor practices. This shift reflects a rejection of the “hustle culture” that glorified relentless work, in favor of a more holistic approach to life and labor.

This generational push for fairness extends to their willingness to share resources and knowledge, often through online communities. They actively seek information on financial literacy, investment strategies, and how to navigate the complex economic landscape, often independently of institutional guidance, which they sometimes view as biased. The collective action and shared experiences among Gen Z suggest a powerful force for future economic reforms.

New Policies Aimed at Wealth Redistribution

There’s a growing consensus among some economists and policymakers that significant structural changes are necessary to address the widening income gap. The question of Can New Policies Aimed at Wealth Redistribution Reduce the Income Gap by 10% in the Next 5 Years? hinges on the implementation of bold and comprehensive strategies. These policies often involve a combination of taxation, social welfare programs, and labor market reforms.

The goal is not simply to redistribute existing wealth but to create a more equitable system for future wealth generation and opportunity. This involves examining the very mechanisms through which wealth is accumulated and passed down, and identifying points where interventions can foster greater fairness. The discussion around these policies often stirs intense debate, as they challenge existing economic paradigms.

Progressive Taxation and Wealth Taxes

One of the cornerstone policies for wealth redistribution is progressive taxation, where higher earners pay a larger percentage of their income in taxes. This can be extended to include wealth taxes, which levy annual taxes on an individual’s total net worth, including assets like real estate, stocks, and other investments. Proponents argue that such taxes can significantly narrow the wealth gap and generate revenue for public services.

- Increased top marginal tax rates on income.

- Implementation of a recurring wealth tax on assets above a certain threshold.

- Stricter enforcement of existing tax laws to prevent evasion by the wealthy.

While wealth taxes have been met with resistance in some countries due to implementation challenges and concerns about capital flight, their potential for revenue generation and direct redistribution is undeniable. The debate often centers on balancing the need for equity with potential economic disincentives, but the growing Gini coefficient (a measure of income inequality) highlights the urgency of such discussions.

Enhanced Social Safety Nets and Public Services

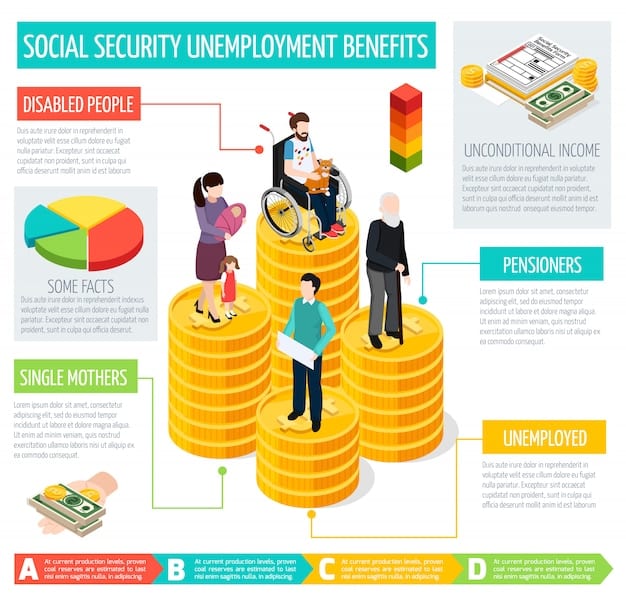

Another critical area for wealth redistribution involves strengthening social safety nets and expanding access to high-quality public services. This includes universal healthcare, affordable housing initiatives, publicly funded education from pre-K through college, and robust unemployment benefits. These programs directly benefit lower and middle-income individuals, reducing their financial burdens and increasing their disposable income.

Universal Basic Income (UBI) is also gaining traction as a potential policy. UBI provides a regular, unconditional cash payment to all citizens, irrespective of their income or employment status. Advocates suggest UBI could provide a stable floor beneath all citizens, reducing poverty and allowing individuals greater flexibility in pursuing education, entrepreneurship, or caregiving without the constant threat of financial destitution.

These policies aim to create a more level playing field, ensuring that everyone has access to basic necessities and opportunities, regardless of their starting point. The investment in human capital through education and healthcare, combined with direct financial support, can significantly impact intergenerational poverty and foster upward mobility for those currently held back by economic constraints.

Feasibility of a 10% Income Gap Reduction

Achieving a 10% reduction in the income gap within five years is an ambitious target that would require a concerted and immediate policy effort. Evaluating the feasibility of Can New Policies Aimed at Wealth Redistribution Reduce the Income Gap by 10% in the Next 5 Years? requires careful consideration of historical precedents, economic models, and political will. While challenging, it is not entirely outside the realm of possibility if executed effectively.

Historical data indicates that significant reductions in income inequality have occurred in the past, often during periods of major social and economic upheaval or as a result of specific policy interventions, such as the New Deal era in the United States. However, these changes typically materialized over longer periods, suggesting the need for extremely focused and impactful measures to meet a five-year goal.

Economic Models and Projections

Economists use various models to project the potential impact of wealth redistribution policies. Simulations incorporating progressive taxation, expanded social programs, and minimum wage increases often show substantial reductions in income inequality. For instance, some models suggest that a combination of a modest wealth tax and expanded social spending could lead to a noticeable decrease in the Gini coefficient within a few years.

However, these models also highlight the sensitivity of outcomes to specific policy parameters and the broader economic environment. Factors like inflation, global economic trends, and unforeseen economic shocks can influence the effectiveness of these policies. Therefore, any policy implementation would need to be flexible and adaptive, monitored closely to ensure it is achieving its intended effects.

- Simulations suggest a combination of policies is more effective than isolated measures.

- Dynamic economic conditions require adaptive policy frameworks.

- Accurate data collection and analysis are crucial for tracking progress.

Political Will and Public Support

The primary barrier to achieving a 10% reduction in the income gap within five years is often political, not purely economic. Implementing significant wealth redistribution policies requires immense political will, broad public support, and the ability to overcome strong opposition from entrenched interests who benefit from the current system. Lobbying efforts against such changes are often well-funded and highly organized, creating a formidable hurdle even when there is public desire for change.

Furthermore, the success of these policies depends on their acceptance and active participation by the populace. If new tax structures are perceived as unfair or overly burdensome, they may face widespread non-compliance or generate significant backlash that undermines their effectiveness. Therefore, public education and transparent communication about the benefits of these policies are as crucial as their design.

Ultimately, a 10% reduction is ambitious but achievable under specific, favorable conditions: strong political leadership committed to equity, widespread public understanding and backing, and a robust, well-designed policy framework. Without these elements, even the most well-intentioned policies could fall short of such a significant goal.

Challenges and Criticisms of Redistribution Policies

While the concept of wealth redistribution garners significant support, particularly among younger generations, its implementation is fraught with challenges and attracts considerable criticism. Understanding these obstacles is key to a realistic assessment of Can New Policies Aimed at Wealth Redistribution Reduce the Income Gap by 10% in the Next 5 Years? The criticisms often revolve around economic efficiency, individual liberty, and the practicalities of implementation.

Opponents frequently argue that such policies can disincentivize economic activity, reduce investment, and potentially lead to capital flight. There are also concerns about the administrative burden of implementing complex new tax structures, as well as the potential for government inefficiency or corruption in managing large-scale social programs. These criticisms highlight the delicate balance required to design policies that are both equitable and economically sound.

Potential Economic Disincentives

A common argument against high progressive taxes and wealth taxes is that they can disincentivize hard work, entrepreneurship, and investment. Critics suggest that if a significant portion of additional earnings or accumulated wealth is taxed away, individuals and businesses may have less motivation to innovate, expand, or take financial risks. This could, in theory, lead to slower economic growth, fewer jobs, and a smaller overall economic pie to redistribute.

- High taxes on capital gains may deter investment.

- Concerns about “brain drain” if top earners decide to relocate.

- Debate over the Laffer Curve and optimal tax rates.

However, proponents counter that moderate progressive taxation does not necessarily harm economic growth and can even stimulate it by increasing demand among lower-income groups who have a higher propensity to spend. They also argue that the current levels of inequality themselves act as a significant drag on economic potential by limiting opportunities for large segments of the population.

Implementation Hurdles and Global Capital Mobility

Beyond economic theory, the practical implementation of wealth redistribution policies, especially wealth taxes, poses significant hurdles. Valuing complex assets like private businesses, art collections, or intellectual property for tax purposes can be extremely difficult. There are also concerns about capital mobility, where wealthy individuals and corporations might move their assets or even their residency to countries with more favorable tax regimes, thus undermining the policy’s effectiveness.

International coordination would be essential to prevent such tax avoidance, but achieving global consensus on tax policies is notoriously challenging. Domestically, the administrative costs associated with tracking and enforcing new wealth taxes could be substantial, requiring significant investment in government agencies and sophisticated data systems. These complexities mean that poorly designed or implemented policies could result in unintended negative consequences.

Furthermore, there is the risk of political capture, where policies intended to benefit the many are distorted to serve special interests. Ensuring transparency and accountability in the design and execution of redistribution programs is crucial to build public trust and ensure their long-term success. The path to a more equitable society is rarely straightforward, requiring constant vigilance and refinement of policies.

Gen Z’s Long-Term Impact and the Future

The response of Gen Z to economic inequality is not merely a transient phase but indicative of a long-term shift in societal values and expectations. Their lived experiences and active advocacy suggest that regardless of whether a 10% income gap reduction is achieved in the next five years, their influence will continue to shape economic policy debates for decades to come. Gen Z’s Response to Economic Inequality will have profound implications for the future of capitalism, social welfare, and political discourse.

This generation’s emphasis on equity, sustainability, and collective well-being over individual accumulation is likely to put sustained pressure on governments and corporations to adopt more responsible and inclusive practices. Their digital fluency and global awareness also mean that their movements for change can quickly gain international traction, challenging nationalistic approaches to economic problems.

Shifting Economic Paradigms

Gen Z’s discontent with the status quo could catalyze a fundamental re-evaluation of economic paradigms. They are more open to alternative economic models, such as stakeholder capitalism, where businesses prioritize the interests of employees, customers, and the community in addition to shareholders. Concepts like degrowth, circular economy, and community-led economic development resonate strongly with their values, contrasting sharply with traditional growth-at-all-costs models.

- Increased focus on environmental, social, and governance (ESG) criteria in investment.

- Demand for ethical supply chains and fair labor practices.

- Growing interest in cooperative and worker-owned business models.

This shift could lead to a future where economic success is measured not just by GDP, but by metrics of well-being, equity, and environmental health. The adoption of such broader measures could fundamentally alter policy priorities, moving away from purely financial objectives towards more holistic societal goals. This would represent a significant departure from the neoliberal economic doctrines that have dominated global policy for decades.

Intergenerational Collaboration and Conflict

The pursuit of economic justice by Gen Z will inevitably involve both collaboration and potential conflict with older generations. While some older individuals and policymakers may align with Gen Z’s goals, particularly those who have also experienced economic hardship, others may resist changes that they perceive as challenging their established economic interests or values. Bridging this intergenerational gap will be crucial for effective policy implementation.

Education, empathy, and open dialogue will be essential to foster understanding between generations and build broad coalitions for change. Highlighting the long-term benefits of a more equitable society for everyone, including economic stability and reduced social unrest, can help garner wider support. Gen Z’s persistence and growing political power mean that the conversation around economic inequality will only intensify, making it impossible for policymakers to ignore.

In conclusion, while the immediate goal of a 10% income gap reduction is challenging, Gen Z’s persistent advocacy for economic justice guarantees that the pressure for significant wealth redistribution will remain a defining feature of the coming decades. Their impact will extend beyond specific policy outcomes, fundamentally reshaping how societies approach economic governance and the pursuit of collective prosperity.

| Key Point | Brief Description |

|---|---|

| 📉 Gen Z’s Economic Struggles | Facing high student debt, housing costs, and stagnant wages compared to previous generations, leading to economic insecurity. |

| ✊ Advocacy for Justice | Active in social media activism and political engagement, pushing for systemic changes like progressive taxation and UBI. |

| ⚖️ Redistribution Policies | Proposals include wealth taxes, enhanced social safety nets, and increased public services to narrow the income gap. |

| 🎯 Feasibility & Challenges | Achieving a 10% reduction requires strong political will, broad public support, and careful policy design to overcome economic and logistical hurdles. |

Frequently Asked Questions About Economic Inequality & Gen Z

Gen Z entered adulthood facing significant economic headwinds, including high student loan debt, exorbitant housing costs, and limited opportunities for upward mobility. Their digital native status also means constant exposure to global disparities, amplifying their awareness and frustration with systemic inequalities.

Common proposals include progressive taxation (higher taxes on the wealthy), wealth taxes on assets, universal basic income (UBI), increased funding for social safety nets like universal healthcare and affordable housing, and strengthening labor protections and minimum wage laws.

Achieving a 10% reduction is ambitious but possible. It would demand unprecedented political will, a comprehensive suite of well-designed policies, and strong public support. Historical precedents show significant shifts can occur, but typically over longer timeframes, underscoring the challenge.

Critics often argue these policies can disincentivize economic activity and investment, potentially leading to slower growth or capital flight. There are also concerns about administrative complexities, the potential for government inefficiency, and impacts on individual liberty.

Gen Z’s sustained pressure could lead to a fundamental re-evaluation of economic paradigms, promoting models like stakeholder capitalism and prioritizing well-being and sustainability over pure GDP growth. Their influence will likely reshape future policy debates and corporate social responsibilities.

Conclusion

The dialogue surrounding Gen Z’s Response to Economic Inequality: Can New Policies Aimed at Wealth Redistribution Reduce the Income Gap by 10% in the Next 5 Years? is more than just an academic exercise; it’s a reflection of urgent societal challenges. While the target of a 10% reduction in the income gap within five years is undeniably ambitious, Gen Z’s heightened awareness, proactive advocacy, and increasing political power suggest that the momentum for change is building. The feasibility of such a significant shift hinges not only on innovative policy design but also on the collective political will to challenge entrenched economic structures. The ongoing push for equitable wealth distribution is a defining characteristic of this generation, ensuring that the pursuit of economic justice will remain a central theme in global policy discussions for the foreseeable future, shaping the very foundation of our economic systems.